Blog listing

EEOC Says Collecting Family Members’ COVID-19 Test Results Violates GINA

EOCC announced it had entered into a conciliation agreement with a Florida-based dermatology practice for violations of the Genetic Information Non-Discrimination Act (GINA).

Read Moreabout EEOC Says Collecting Family Members’ COVID-19 Test Results Violates GINA

HHS to Extend Public Health Emergency Once Again

HHS last extended the public health emergency in May of 2022.

Read Moreabout HHS to Extend Public Health Emergency Once Again

California to Manufacture Insulin

Governor Newsom announces the state will produce insulin.

Read Moreabout California to Manufacture Insulin

New National Mental Health Hotline

Starting July 16th, 2022, the first nationwide three-digit mental health crisis hotline goes live.

Read Moreabout New National Mental Health Hotline

3 Must-Have Benefits That Make Returning to the Office More Appealing

Most of America has decided it is time to put COVID behind us and get back to life. The business world is following suit, bringing workers back to the office in hopes of restoring what was before coronavirus. But there's a problem: just 3% of America's white collar workers have a genuine interest in being back in the office every day of the week.

Read Moreabout 3 Must-Have Benefits That Make Returning to the Office More Appealing

Why Plans That Include Cancer Screening Benefits are More Important Than Ever

Employee benefits have been part of the American landscape for more than two generations. Over the years, they have evolved. Even now, how employees perceive their benefits in the wake of the COVID pandemic and the ongoing Great Resignation is forcing yet more evolution in the benefits space. This evolution suggests that complete benefits packages are more important than ever.

Read Moreabout Why Plans That Include Cancer Screening Benefits are More Important Than Ever

4 Expectations of the Modern Workforce

In recent months we have talked at length about the Great Resignation and the COVID pandemic. Both have permanently impacted the modern workplace in ways we will not fully understand for a long time. Yet to the extent we understand those changes right now, we also understand that the modern workforce is changing too. So are their expectations.

Read Moreabout 4 Expectations of the Modern Workforce

Pet Benefits: A Solution That Gives Employers a Hiring Edge

A big part of being a full-service broker is offering benefit plans the modern workforce wants. When you do that, you give your clients a hiring edge. Benefits packages that meet modern needs give new hires a reason to choose your client over another employer. They give current employees a good reason to stay. With that in mind, we would like to introduce you to pet benefits.

Read Moreabout Pet Benefits: A Solution That Gives Employers a Hiring Edge

How the Great Resignation Is Impacting Employees Left Behind

There is little debate anymore over whether the Great Resignation is real or not. The evidence is all around us. Millions of people have quit their jobs over the last 14 months. Some have done so in the hope of finding a better opportunity elsewhere.

Read Moreabout How the Great Resignation Is Impacting Employees Left Behind

Securing Data Transmission in the Digital Transformation

Digital transformation has been a hot topic in our industry for the last six to 12 months, and for good reason. Digital technologies have revolutionized how benefits packages are sold and administered. Yet despite everything that digital transformation offers, it is not without its concerns. Among them is the secure transmission of data.

Read Moreabout Securing Data Transmission in the Digital Transformation

Brokers Should Seriously Consider the Senior Benefits Market–Here's Why

Insurance offerings for seniors doesn’t tend to get a lot of play among brokers focusing primarily on group benefits for employers. That's too bad because the senior health insurance market is one well worth exploring by any broker looking to grow substantially in the coming years. As a general agency, we encourage you to take a serious look at the senior market.

Read Moreabout Brokers Should Seriously Consider the Senior Benefits Market–Here's Why

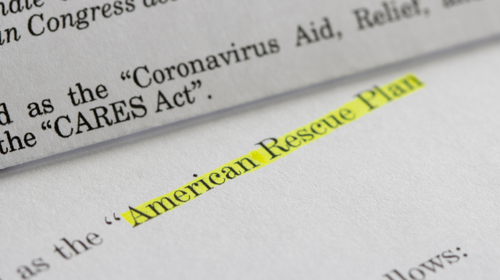

The American Rescue Plan Act Provides for COBRA Subsidies

The American Rescue Plan Act (ARPA) was signed into law on March 11, 2021. One of the many important provisions of this new law is the availability of COBRA subsidies.

Read Moreabout The American Rescue Plan Act Provides for COBRA Subsidies