HRA vs. HSA vs. FSA: Breaking Down the Alphabet Soup of Healthcare Savings

May 15, 2025

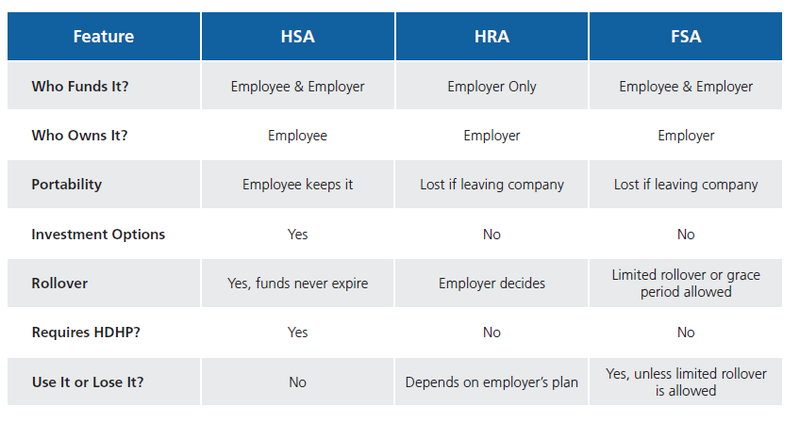

If you’ve ever had a client ask, “Which is better, an HSA, an HRA, or an FSA?” you know that answering isn’t as simple as picking a favorite. These three accounts help employees cover healthcare expenses on a tax-advantaged basis, but they work in different ways. The best choice depends on the employer’s budget, the type of health plan offered, and how much flexibility employees need.

As a benefits professional, you already understand the basics, but let’s dig deeper into how to position these options in a way that makes sense for your clients and keeps you looking like the expert they rely on.

HEALTH SAVINGS ACCOUNTS (HSAs): THE LONG-TERM PLAYER

HSAs provide a way for employees to save for both current and future medical expenses while enjoying significant tax advantages. To qualify, employees must be enrolled in an HSA-compatible high-deductible health plan (HDHP). HSA-compatible HDHPs have no first-dollar coverage except for preventive-care services like your annual wellness visit and gender and age-appropriate preventive care. Both employees and employers can contribute to an HSA, and the funds belong to the employee, meaning they can take their savings with them if they change jobs.

One of the biggest perks of an HSA is that funds never expire. Unused money rolls over year after year, allowing employees to accumulate savings that can even be invested for long-term growth, much like a retirement account. The triple tax advantage of tax-free contributions, tax-free growth, and tax-free withdrawals for qualified expenses makes HSAs a powerful savings tool. As of 2024, nearly 38 million HSAs collectively hold approximately $137 billion in assets, demonstrating their growing role in healthcare planning.

When it comes to account flexibility for employees, HSAs take the crown. Unlike FSAs, which have a “use-it-or-lose-it” rule, and HRAs, which the employer controls, HSAs are the only account that lets you dip into the funds for non-medical expenses if needed. There’s a 20 percent penalty (plus taxes) if you do this before age 65, but after that, the penalty disappears, and you can use the money however you’d like, though non-medical withdrawals are still taxed as income. This makes HSAs a good retirement savings tool while still covering your financial needs along the way. However, HSAs come with trade-offs. Because they require an HDHP, employees must be comfortable with higher out-of-pocket costs before insurance coverage begins. This may not be ideal for those with frequent healthcare needs. Employees must also manage their own contributions and investments, which requires financial literacy and planning.

Health Reimbursement Arrangements (HRAs): Employer-Controlled Flexibility

HRAs put employers in the driver’s seat when it comes to reimbursing employees for healthcare expenses. Unlike HSAs, only employers can contribute, and they determine the rules for how the funds can be used. HRAs provide a structured way to help employees cover medical expenses without requiring them to contribute their own money upfront.

One of the biggest advantages of HRAs is their flexibility. Employers decide how much to contribute, what expenses are eligible for reimbursement, and whether funds roll over at the end of the year. With the emergence of Individual Coverage HRAs (ICHRAs), businesses can even reimburse employees for individual health insurance premiums, making HRAs a strong alternative to traditional group plans.

Recent regulatory changes have made HRAs even more appealing, particularly for businesses that want to offer benefits without the cost or complexity of a traditional group plan. The introduction of ICHRAs in 2020 allowed employers to reimburse employees for individual health insurance, and new IRS guidance has provided additional clarity on compliance requirements. There is also growing discussion around potential expansions that could allow HRAs to cover a broader range of expenses, reinforcing their role as a valuable option for benefits planning. Some policymakers have proposed increasing HRA contribution limits or loosening restrictions on how they interact with other benefits, which could make them even more attractive for employers. While no official changes have been finalized, ongoing legislative conversations suggest that HRAs may continue to evolve in the coming years.

When it comes to Health Reimbursement Arrangements (HRAs), there’s more flexibility out there than many realize. For example, the Qualified Small Employer Health Reimbursement Arrangement (QSEHRA) is a great fit for smaller groups. It’s designed for groups with fewer than 50 full-time employees and allows them to help cover individual premiums and medical expenses without offering a group plan. Then there’s the Group Coverage Health Reimbursement Arrangement (GCHRA), which pairs with a traditional group health plan—usually a high-deductible one—and helps cover out-of-pocket costs like deductibles and copays. Bottom line: there’s an HRA solution for almost every client scenario and being familiar with these options can help you bring real value to your groups.

HRAs do have limitations. Employees don’t own the funds, so if they leave the company, they lose access to any unused money. Employers must also manage the administrative side, tracking reimbursements and ensuring compliance with IRS regulations.

Flexible Spending Accounts (FSAs): Use It or Lose It

FSAs allow employees to set aside pre-tax dollars for qualified medical expenses, reducing taxable income and lowering healthcare costs. Employers can also contribute to FSAs, but unlike HSAs, employees do not retain the funds if they leave their job. A key feature of FSAs is that they are available to employees regardless of what type of health insurance they have. However, FSAs operate under a “use it or lose it” rule, meaning funds must typically be used within the plan year. Some employers offer a small rollover or grace period, but otherwise, unused funds are forfeited.

In 2025, the IRS increased the maximum FSA contribution to $3,300, with a carryover limit of $660, which could influence how employees plan their healthcare spending. Additionally, the IRS has expanded the list of eligible expenses over the years, especially following the CARES Act. Items like over-the-counter medications (without a prescription), menstrual care products, and certain telehealth services are now reimbursable, making FSAs more versatile and valuable for everyday health needs. This structure makes FSAs useful for employees who have predictable medical expenses but less appealing for those who want long-term savings. Employees must carefully estimate their yearly healthcare costs to avoid losing unused funds.

What Brokers Should Do

With rising healthcare costs and changing regulations, brokers play a pivotal role in helping employers and employees make informed choices. A one-size-fits-all approach doesn’t work, and the most effective brokers tailor their recommendations based on company size, workforce demographics, and industry needs.

For small businesses with tight budgets, an ICHRA could be a game-changer, allowing them to offer health benefits without the administrative burden of a group plan. Employers with a younger, healthier workforce may find HSAs to be a strong fit, since employees can benefit from tax-advantaged savings that grow over time. In industries with high turnover, FSAs provide a way for employees to set aside pre-tax dollars for medical expenses without requiring long-term account management. HRAs are a strong option for organizations that want a structured but flexible way to contribute to employee healthcare costs without requiring employees to contribute their own funds.

Helping clients understand these strategic considerations rather than simply listing options positions brokers as trusted advisors who provide real value in benefits decision-making.

The Bottom Line

There’s no one-size-fits-all answer when it comes to HSAs, HRAs, and FSAs. Each has advantages, and the right choice depends on factors like plan eligibility, employer funding ability, and employee healthcare needs. Brokers who can effectively communicate these options add tremendous value to their clients, ensuring they make well-informed decisions tailored to their workforce.

Understanding the ins and outs of healthcare savings accounts can be challenging, but brokers don’t have to figure it all out alone. At BenefitMall, we take a hands-on approach, equipping brokers with the knowledge, resources, and personalized support they need to better serve their clients. Whether it’s staying ahead of compliance changes, understanding contribution limits, designing the right benefits mix, or breaking down the differences in HSAs, HRAs, and FSAs, we’re here to help simplify the process. Let’s work together to create smarter benefits solutions.

Contributor: Patti Reimer is the Benefits Sales Executive for BenefitMall’s Value Added Products.

End Notes: